Lender Plus

New product

The program "Creditor Plus" is intended for the calculation of consumer loans, has a univers

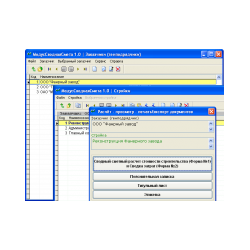

The program "Creditor Plus" is intended for the calculation of consumer loans, has a universal loan calculator (annuity, differential, grace period). The program is used in credit institutions and calculates interest payments on loans and installments of payments, as well as the accounting of borrowers and guarantors, their collateral control of payments on the loan in accordance with the schedule of repayment and registration of accompanying documentation, etc. The program is an extended version of the program 'Creditor' . Its main feature is the restriction of access rights. The initial password for logging in with manager rights is 'patron '. Accompanying documentation is made in automatic mode! It is enough just a few mouse clicks to import the filling of the client data, including via the Internet! The program is easy to use and does not require the user to have a thorough knowledge of banking.

For the convenience of using the program, it is specially designed: Internet Service Questionnaire

In the online service, the user, using the questionnaire designer, can create any number of questionnaires with any number of fields, and also upload ready-made questionnaires to the server, which will be available for download by clients. After the questionnaire is filled in the Internet service, the user will receive an e-mail with an attachment containing a file in CSV or Excel format, the data in which are automatically imported into the program.

The program provides the user with the following options:

• Keep records of borrowers in accordance with their status ("credit processing", "loan issued" and "loan repaid");

• Import necessary borrower data from specially prepared questionnaires in Excel or CSV format (through a specially designed Internet service);

• Obtain both a digital and visual diagram, a reference for economic indicators such as the volume of loans issued, the planned and actual volume of payments by borrowers. Print help information.

• Use several credit organizations (creditors) in the program;

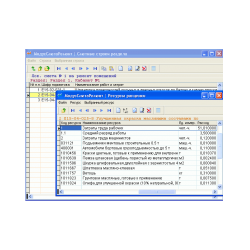

• Independently form credit plans and conduct credit calculations in various time options;

• Keep a record of the guarantors for each borrower;

• Keep records of collateral properties of both borrowers and guarantors;

• Store in the database scanned copies of documents confirming the property of the pledger;

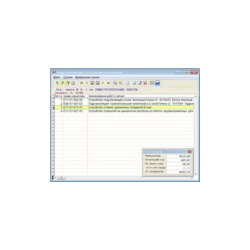

• Prepare the necessary documentation for the loan (loan agreement, pledge agreement, guarantee agreement, annexes to contracts and other necessary documents) and print out its Word in the automatic filing mode;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

For the convenience of using the program, it is specially designed: Internet Service Questionnaire

In the online service, the user, using the questionnaire designer, can create any number of questionnaires with any number of fields, and also upload ready-made questionnaires to the server, which will be available for download by clients. After the questionnaire is filled in the Internet service, the user will receive an e-mail with an attachment containing a file in CSV or Excel format, the data in which are automatically imported into the program.

The program provides the user with the following options:

• Keep records of borrowers in accordance with their status ("credit processing", "loan issued" and "loan repaid");

• Import necessary borrower data from specially prepared questionnaires in Excel or CSV format (through a specially designed Internet service);

• Obtain both a digital and visual diagram, a reference for economic indicators such as the volume of loans issued, the planned and actual volume of payments by borrowers. Print help information.

• Use several credit organizations (creditors) in the program;

• Independently form credit plans and conduct credit calculations in various time options;

• Keep a record of the guarantors for each borrower;

• Keep records of collateral properties of both borrowers and guarantors;

• Store in the database scanned copies of documents confirming the property of the pledger;

• Prepare the necessary documentation for the loan (loan agreement, pledge agreement, guarantee agreement, annexes to contracts and other necessary documents) and print out its Word in the automatic filing mode;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

• Create a document yourself;

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)